Debt to Capital Ratio Explained

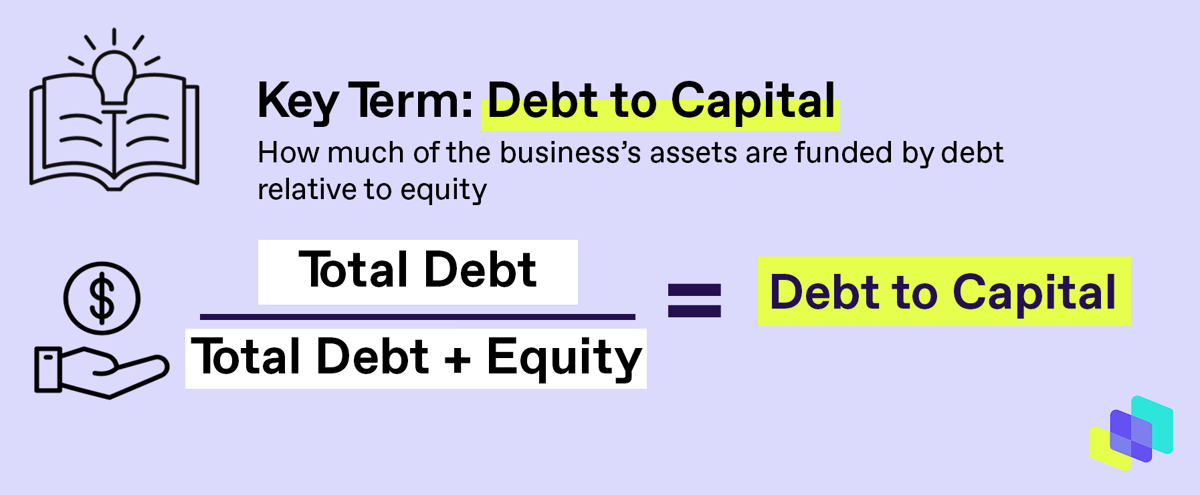

What is Debt to Capital?

Debt to Capital is a financial metric that shows how much of your business's capital structure is funded by debt relative to equity. It helps you understand how reliant your business is on debt to finance its operations and assets.

Understanding the components of debt to capital:

- Debt: This includes all interest-bearing obligations a business holds, both short-term (e.g., lines of credit) and long-term debt (e.g., bank loans, bonds).

- Equity: Equity represents the ownership interest in the company, which is the residual interest after all liabilities are deducted from assets. It's made up of initial capital invested by owners/shareholders, retained earnings, and other forma of equity like additional paid-in capital.

Together, debt and equity form the business's capital structure, and understanding this balance is crucial for long-term financial health.

IN THIS ARTICLE:

→ Debt to Capital Formula

→ Debt to Capital vs. Debt to Equity: What's the Difference?

→ Why Debt to Capital is Important

→ What is a Healthy Debt to Capital Ratio?

→ How to Improve Debt to Capital

→ How Debt to Capital Ratio Relates to Business Risk

→ Link Between Debt to Capital Ratio and Profitability

→ How Debt to Capital Influences Business Valuation

→ Monitor Debt to Capital Over Time

→ How a Virtual CFO Can Impact Your Debt to Capital Ratio

Debt to Capital Formula

Debt to Capital = Total Debt ÷ (Total Debt + Equity)

This calculation provides insight into the balance between debt and equity within your business. It shows the proportion of your financing that comes from borrowing versus what is funded by the business's own value.

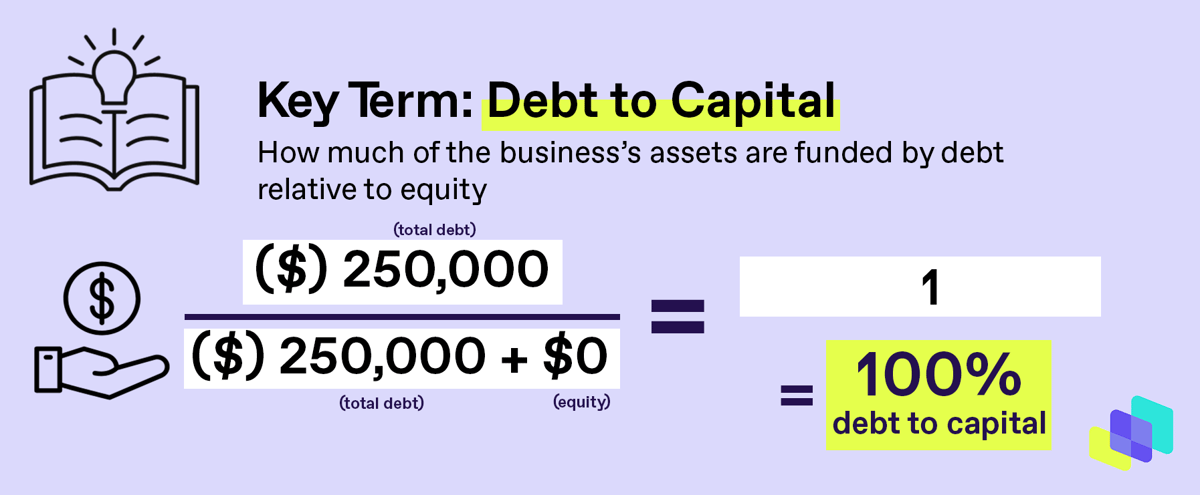

Let's say your business purchases a truck for $250,000, funded entirely through a loan (debt), and you have no other assets or equity in the business at this stage. Your debt to capital would be 100% because:

- Debt = $250,000 (loan for the truck)

- Equity = $0 (no other assets or owner investment)

- Debt to capital = $250,000 ÷ ($250,000 + $0) = 100%

Debt to Capital Formula

Debt to capital vs Debt to Equity: What's the Difference?

While similar, the debt to capital ratio offers a broader view than debt to equity:

- Debt to Capital: Measures total debt as a proportion of the total capital structure (debt plus equity)

- Debt to Equity: Compares debt to just the equity portion. The debt to capital ratio includes both equity and debt, providing a more comprehensive view of the capital structure.

Why Debt to Capital is Important

This ratio tells us how much of the business's capital comes from debt versus equity, giving insight into the company's financial leverage. Expanding on its importance:

- Financial Leverage: A higher reliance on debt means the business is more leveraged. While leveraging debt can boost returns when business is going well, it also increases the business's risk exposure, especially in periods of lower profitability.

- Creditworthiness: Lenders and investors scrutinise this ratio to assess how risky it is to lend or to invest in the company. A company heavily reliant on debt may find it harder to access credit or may face higher interest rates due to perceived risk.

- Long-Term Sustainability: A balanced capital structure - where debt and equity are optimally balanced - helps businesses manage cash flow, sustainably finance growth, and avoid liquidity issues in downturns.

What is a Healthy Debt to Capital Ratio?

An ideal debt to capital ratio generally falls between 40% and 60%, though this can vary based on business circumstances:

- 40-60%: A balanced capital structure, providing room for growth without taking on excessive financial risk.

- Over 60%: This can signal that a business is becoming too reliant on debt, which may increase risk if profits are not strong enough to manage repayments.

However, it's important to consider this number in the context of your business's returns. If your returns are high, a higher debt ratio may not be as risky because you have the cash flow to support repayments. Conversely, a low debt ratio can still be risky if the business is not generating profit.

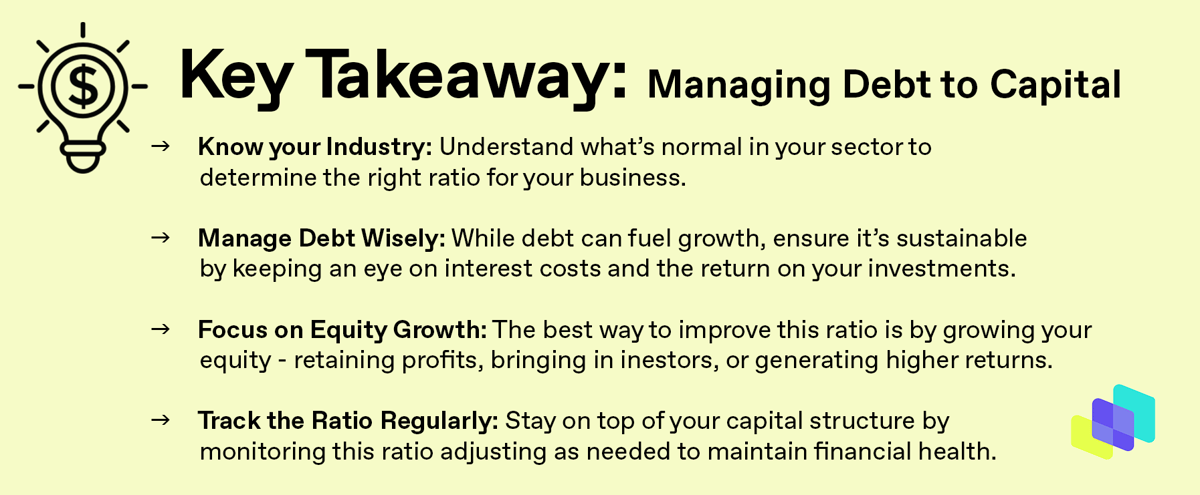

Like the debt to equity ratio, the ideal debt to capital ratio can vary depending on your industry:

- Capital-intensive industries (e.g., manufacturing, infrastructure, and real estate) often carry higher levels of debt due to the nature of large, long-term investments. A higher debt to capital ratio can be more acceptable here.

- Service-based industries typically have lower debt levels, relying more on human capital and less on physical assets, so their debt to capital ratios should be lower.

How to Improve Debt to Capital

If your debt to capital ratio is too high, here are practical steps you can take to reduce it:

- Reduce debt strategically: Focus on paying off high-interest debt or refinancing debt to improve terms. This helps reduce financial strain and risk.

- Increase equity: Retain earnings to boost equity or consider bringing in new investors who can inject capital. As equity grows, the ratio naturally improves.

- Optimise cash flow: Ensuring strong operational cash flow can allow you to service debt more efficiently and build equity over time.

- Enhancing Operations: Better operational performance leads to higher profitability, which reduces the pressure on debt.

- Smart Asset Use: If assets like the truck from the earlier example significantly improve profitability, your equity will grow faster, reducing the reliance on debt.

How Debt to Capital Ratio Relates to Business Risk

The debt to capital ratio directly influences a company's financial risk:

- Higher ratios indicate a business is more reliant on debt, meaning it has more obligations to service (interest payments, principal repayments), which can strain cash flow, especially in tough times.

- Lower ratios suggest a business is less risky, as it is far less dependent on debt. It has more flexibility and can weather downturns more effectively.

- Balance risk and opportunity: Debt can be useful to finance growth and enhance returns, but excessive debt without sufficient equity backing can lead to over-leverage, increasing the company's vulnerability.

Link Between Debt to Capital Ratio and Profitability

When debt is used wisely, it can boost profitability through leverage:

- Positive Leverage: If the returns generated from using debt exceed the cost of servicing that debt, it enhances profitability. This is particularly useful when financing growth projects, new ventures, or asset purchases

- Negative Leverage: If the cost of debt is higher than the returns it generates, it erodes profitability. This becomes particularly challenging during downturns or when the business underperforms.

How Debt to Capital Influences Business Valuation

The debt to capital ratio also plays a significant role in valuing a business.

- Investor Perception: Investors may view a business with a high debt to capital ratio as riskier, potentially lowering its overall valuation. Businesses with healthier ratios may command higher valuations as they are seen as more stable and financially secure.

- Impact on Cost of Capital: Companies with a lower debt to capital ratio may benefit from a lower cost of capital, making it cheaper to finance future projects or investments.

Monitor Debt to Capital Over Time

Tracking this ratio over time is essential to ensuring your business remains financially healthy.

- Fluctuations: A business may see natural fluctuations in its debt to capital ratio as it takes on debt for new projects or expands. The key is to manage this fluctuations and ensure they don't signal over-leverage.

- Strategic Management: Regularly review the ratio in conjunction with your overall business strategy, ensuring your are balancing growth opportunities with the need to maintain overall financial stability.

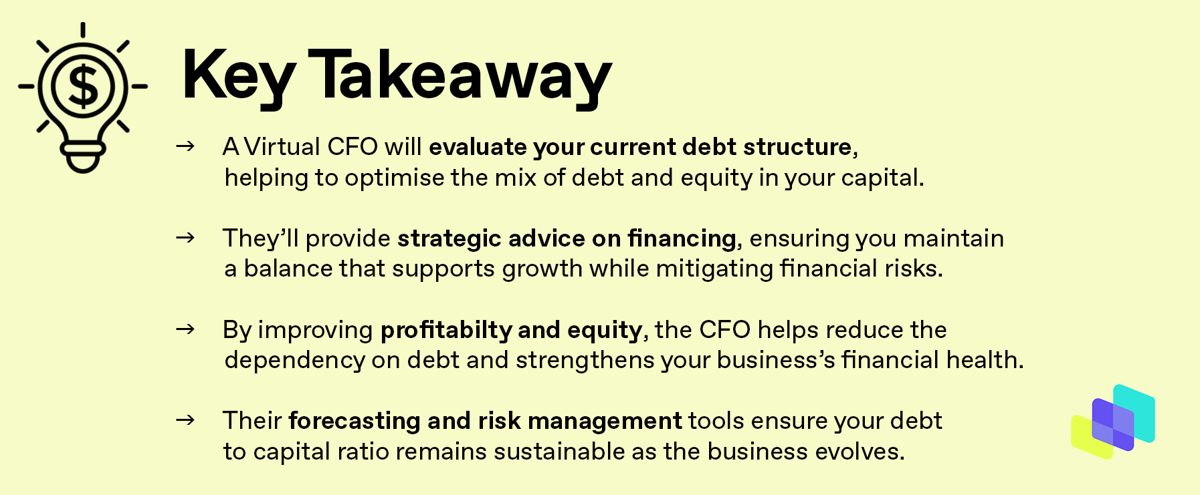

How Can a Virtual CFO Assist?

A Virtual CFO can provide significant support in managing your debt to capital ratio, ensuring your business maintains a healthy balance between debt and equity. Here's how we, at CFO Dynamics, could help you as your Virtual CFO.

1. Assessing Your Debt Structure

A Virtual CFO will review the structure of your existing debt to determine how much of your business's capital is financed by debt versus equity. They will:

- Analyse your current debt to capital ratio to see if it's in a healthy range (typically between 40-60% for many businesses)

- Review the terms of your debt agreements, interest rates, and repayment schedules to evaluate their long-term impact on on your financial health.

2. Debt Management Strategy

We can create a tailored strategy to optimise your debt to capital ratio. This includes:

- Refinancing: Recommending opportunities to refinance debt at lower interest rates or better terms to improve cash flow and reduce financial pressure.

- Debt repayment plans: Developing structured repayment plans that prioritise high-interest debt, ensuring you pay down debt in a financially stable way.

- Debt consolidation: Advising on whether consolidating multiple loans into a single loan with better terms could simplify management and reduce costs.

3. Capital Planning and Funding Decisions

With CFO Dynamics as your Virtual CFO we can help you make smarter decisions about when and how to raise new capital or take on additional debt. This includes:

- Evaluating whether you should raise funds through debt (e.g., loans or bonds) or equity (e.g., selling shares or reinvestments of profits), balancing the need for growth while maintaining financial health.

- Assessing the risks and benefits of each financing option to ensure you are not over-leveraging your business.

4. Improving Equity and Profitability

One of the most effective ways to improve your debt to capital ratio is by increasing equity through profit generation. A skilled Virtual CFO should:

- Enhance Profitability: Implement strategies to grow your business's profitability, which in turn increases equity and strengthens your balance sheet.

- Maximise ROI on Debt: Ensure that the money you borrow is being used effectively to generate returns that exceed the cost of the debt. This helps reduce risk while still boosting equity.

5. Risk Management and Financial Forecasting

Virtual CFOs can perform in-depth risk analysis and long-term financial forecasting to ensure your debt to capital ratio remains healthy a your business grows. They will:

- Conduct stress tests and scenario planning to understand how changes in revenue, interest rates, or expenses could impact your debt to capital ratio.

- Develop contingency plans to manage potential downturns or liquidity challenges while keeping your capita structure intact.

6. Financial Reporting and Compliance

A Virtual CFO will also ensure that your financial reports accurately reflect your debt obligations and equity position, which is essential for transparency and compliance. This includes:

- Preparing detailed financial statements that reflect your debt to capital standing.

- Ensuring all debts are properly accounted for, and equity is correctly represented to give you a clear picture of your capital structure.

Learn everything we teach our clients... for free

Join 400+ business owners & leaders who receive practical business & accounting tips, delivered free to your inbox every week. No fluff, just high-level expertise. Sign up now.